Whose National Debt….Better Look Before You Vote

Nov 01, 2010

Author: SCP Editor

This is a reprint of an article sent to us from our friends at ZFacts (http://www.zfacts.com).

( Especially if you're under 30. )

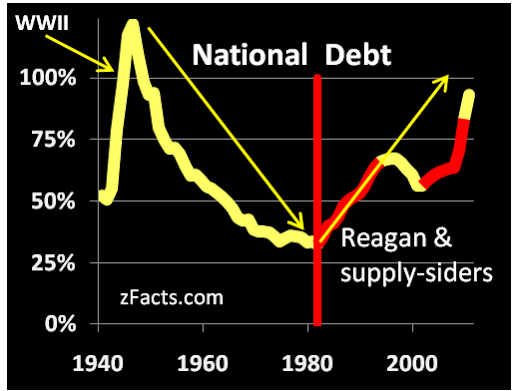

Is our present debt from World War II, when it was the biggest ever?

Then our national debt shot up by (the equivalent of) $10.5 Trillion

That put millions to work, ended the Great Depression and

won World War II.

But look at how fast we paid it down, Republicans and Democrats alike,

to its low point in 1981. Then ...

In 1981 Reagan's supply siders said they would fix the debt, but look above! They wrecked decades of progress in just a few years.

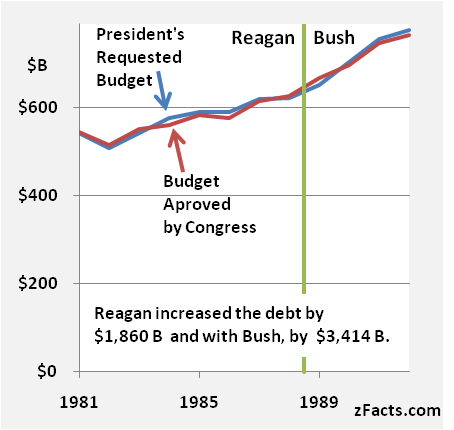

So they're still blaming Congress. But ...

Congressional budgets averaged $2B Less than Reagan asked for.

So you can't blame any of the $3,414 Billion ($3.4T) debt on Congress.

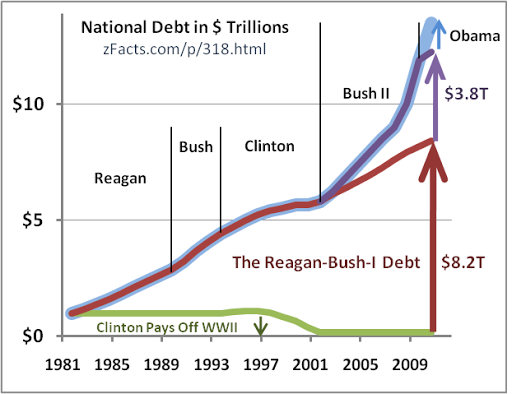

But don't we have to pay interest on that supply-side debt?

You bet.

Almost too amazing to believe!

$12 Trillion of our $13.5T debt is Republican.

But 17 years of compound interest on top of $3.4T comes to $8.2 Trillion.

Without that interest, Clinton would have almost paid off the WWII debt!

The supply-siders are back with the Republican Pledge.

They've made the debt worse 20 out of 20 years (Reagan & 2 Bushes).

Fool me once, shame on you. Fool me 20 times, ...

Don't Vote for Supply Siders if You Care about Our Future!

Please Pass This On to at Least One More Voter

( ... and one person who will keep it going. It's worth thinking about this.

You could start a chain letter that would reach a million! )